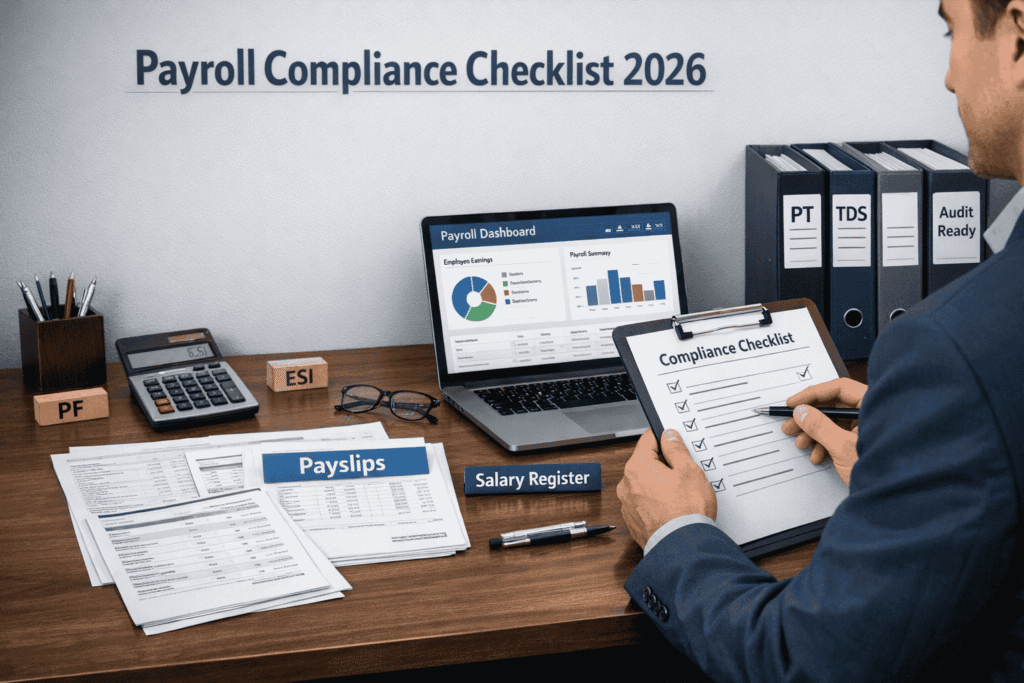

Payroll compliance is the foundation of accurate salary processing, statutory adherence, and audit readiness for Indian businesses in 2026. As labour regulations, documentation standards, and reporting requirements become stricter, companies must ensure that every salary transaction, deduction, and employee record follows legal norms. Failing to maintain proper payroll compliance can lead to penalties, employee disputes, and serious legal complications.

This detailed checklist explains what HR and accounts teams must manage to keep payroll error free, compliant, and efficient.

Why Payroll Compliance Is Critical for Businesses

Strong payroll compliance ensures:

-

Correct salary calculations every month

-

Accurate statutory deductions and filings

-

Proper documentation for labour inspections

-

Transparency in employee payments

-

Reduced financial and legal risks

When payroll is handled casually through spreadsheets and emails, errors become common and compliance suffers.

1. Accurate Employee Master Data

The first requirement for payroll compliance is maintaining complete and updated employee information:

-

PAN, Aadhaar, and bank details

-

Salary structure and CTC breakup

-

Date of joining, role, and employment type

-

Leave and shift records

Incomplete data leads to incorrect tax deductions and salary disputes.

2. Well Defined Salary Structure

Your salary components must be clearly structured:

-

Basic pay

-

HRA and allowances

-

Performance incentives and bonuses

-

Reimbursements and deductions

Improper structuring impacts tax calculation and statutory contributions, affecting overall payroll compliance.

3. Managing Statutory Deductions Correctly

A key part of payroll compliance is calculating and depositing mandatory deductions such as:

-

Provident Fund (PF)

-

Employee State Insurance (ESI)

-

Professional Tax (PT)

-

Tax Deducted at Source (TDS)

Errors or delays here invite penalties and notices.

4. Timely Monthly and Quarterly Filings

Deducting money is not enough. Businesses must file PF, ESI, PT, and TDS returns within deadlines. Missing due dates directly breaks payroll compliance norms.

5. Leave, Overtime, and Holiday Records

Leave balances and overtime payments directly influence salary. Without accurate tracking, payroll becomes inconsistent and non-compliant.

6. Maintain Salary Registers and Payslips

Every organization must keep:

-

Monthly salary register

-

Employee payslips

-

Deduction and bonus records

These are essential documents during audits to prove payroll compliance.

7. Bonus, Gratuity, and Benefit Tracking

Statutory benefits must be calculated and recorded properly. Maintaining these records is another important part of payroll compliance.

8. Proper Full and Final Settlement During Exit

During employee exit:

-

Leave encashment

-

Notice recovery or payout

-

Final deductions

must be processed accurately to maintain payroll compliance and avoid disputes.

9. Keep Documents Audit Ready

Labour officers and auditors may request payroll documents anytime. If data is scattered, retrieving it becomes stressful and risky.

10. Avoid Manual Payroll Errors with Software

Manual payroll increases human errors. Automation helps maintain records, deductions, and reports aligned with payroll compliance requirements.

Common Payroll Compliance Mistakes Companies Make

Many businesses:

-

Forget to update employee records

-

Delay statutory filings

-

Miscalculate leave balances

-

Lose salary documents

-

Handle payroll in Excel sheets

These mistakes accumulate into serious compliance issues over time.

Benefits of Strong Payroll Compliance

When payroll is compliant:

-

Employees trust salary accuracy

-

HR workload reduces

-

Audits become easy

-

Legal risks are minimized

-

Business reputation improves

How BizHrs Helps Maintain Payroll Compliance

BizHrs offers a centralized system to manage employee data, salary records, deductions, and reports in one place.

With BizHrs, you can:

-

Store employee information securely

-

Generate salary registers and payslips

-

Track PF, ESI, PT, and TDS deductions

-

Manage leave, overtime, and settlements

-

Access audit ready reports anytime

This makes payroll compliance a smooth, error free process for HR and accounts teams.

Final Thoughts

In 2026, payroll mistakes are no longer small operational errors. They are compliance risks. Following this checklist and using a reliable HR system ensures that your salary processing remains accurate, transparent, and legally safe.

By strengthening your processes and using BizHrs, payroll compliance becomes a routine task instead of a monthly burden.